When purchasing a property in the UK, one of the most significant additional costs to consider is Stamp Duty Land Tax (SDLT), also known as stamp duty. This crucial aspect of property transactions can have a substantial impact on your budget and overall costs. Whether you're a first-time buyer, looking to invest in a second home, or simply curious about the costs that come with buying a property, this guide will provide you with essential information about stamp duty.

What is stamp duty?

Stamp duty, officially known as Stamp Duty Land Tax (SDLT) in the UK, is a tax levied on property purchases. It applies to both freehold and leasehold properties above a certain price threshold. The stamp duty payable depends on the property's purchase price and whether the buyer is a first-time homeowner or purchasing an additional property. The tax is calculated on a sliding scale, with higher rates for more expensive properties.

The buyer typically pays stamp duty. It must be submitted to HM Revenue and Customs within 14 days of completing the property purchase. The government occasionally adjusts stamp duty rates and thresholds as part of broader economic policies.

How can I be exempt from paying stamp duty?

There are a few ways to potentially avoid or reduce stamp duty when buying a house in the UK:

- First-time buyer relief applies to people purchasing their first home. They pay no stamp duty on properties up to £425,000 and benefit from reduced rates on properties up to £625,000.

- Stamp duty doesn't apply below a certain threshold. Currently, you won't have to pay it if the property you're buying doesn't cost more than £250,000.

- For transfer of property in divorce or separation, no stamp duty is payable.

- If a property is passed down to you as a gift meaning no money is exchanged, stamp duty may not apply.

If you can't avoid stamp duty, you could claim a refund in specific cases. This is the case for uninhabitable properties, meaning that if you buy a derelict property to renovate, you might be able to get that money back.

It's important to note that attempting to avoid stamp duty illegally (like underreporting the purchase price) is tax evasion and carries severe penalties. Always consult with a qualified tax advisor or solicitor for advice specific to your situation.

Are there plans to change the law around stamp duty?

With the general election scheduled for 4th July 2024, major political parties have included proposals for stamp duty reform in their manifestos. These potential changes could significantly impact the property market and homebuyers across the UK. Here's a breakdown of the two main parties' proposals:

The Conservatives have put forward a plan aimed at supporting first-time buyers and stimulating the housing market:

- Permanently abolishing Stamp Duty Land Tax (SDLT) for homes up to £425,000 in England and Northern Ireland.

- This would effectively extend and make permanent the current first-time buyer relief.

- They commit not to increase the rate or level of SDLT for other property purchases.

The Labour's approach focuses more on using stamp duty as a tool to address issues in the property market:

- Increasing stamp duty by 1% on purchases of residential property by non-UK residents.

- This measure aims to cool foreign investment in the UK property market, which some argue contributes to rising house prices.

It's crucial to remember that these are campaign promises and proposed policies. The actual implementation of any changes depends on the election outcome and legislative processes.

How is stamp duty calculated?

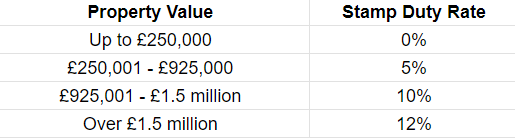

Stamp Duty Land Tax (SDLT) in the UK is calculated using a tiered system based on the property's purchase price.

The Stamp Duty Rate for different property values shown above are from June 2024

For first-time buyers, there is no stamp duty to pay on the first £425,000. For the portion between £425,001 and £625,000, a 5% rate applies. If the property costs over £625,000, standard rates apply.

It's crucial to note that these rates and thresholds can change with government policy, so it's always advisable to check the most current information for SDLT on the government website.

When do I have to pay stamp duty?

Stamp Duty Land Tax (SDLT) must be paid within 14 days of the 'effective date' of the property transaction, which is typically the completion date of the purchase. This is when you become the legal owner of the property.

You have 14 calendar days to file your SDLT return and pay the tax. While your solicitor or conveyancer usually handles this process, it's ultimately your responsibility to ensure it's paid on time. Failing to pay within the 14-day window can result in penalties and interest charges.

SDLT is usually paid through your solicitor, who will transfer the funds to HM Revenue and Customs (HMRC). Even if no tax is due (for example, if the property price is below the threshold), you must still submit an SDLT return within the 14-day period. After payment, you'll receive a certificate from HMRC, which you'll need to register the property in your name with the Land Registry.

Note that for new-build properties, the 14-day clock starts when the property is finished or when you move in, whichever comes first. For new leases, the effective date is usually when the lease is executed or, if earlier, when you take up occupation of the property.

How does stamp duty work for second homes?

Stamp Duty Land Tax (SDLT) for second homes and buy-to-let properties follows different rules compared to primary residences. The key difference is the application of a surcharge.

An additional 3% is added to all SDLT bands for second homes or buy-to-let properties.

Unlike primary residences, there's no tax-free threshold for second homes, and the 3% surcharge applies from the first pound of the purchase price.

The surcharge is added to the standard rates. For example, where a primary residence would incur 0% SDLT, a second home incurs 3%; where a primary residence incurs 5%, a second home incurs 8%, and so on.

A 'second home' is defined as any additional residential property you own or have a share in, including holiday homes and buy-to-let investments. If you're buying a new main residence but haven't sold your previous one, you'll initially pay the higher rates. However, you can claim a refund if you sell your previous main residence within 36 months.

In cases where there are multiple buyers, if any buyer owns another property and isn't replacing their main residence, the higher rates usually apply to the entire purchase. For SDLT purposes, married couples and civil partners are treated as one unit. If either partner owns another property, the surcharge typically applies.

Certain properties, like caravans or houseboats, are exempt from the surcharge. Companies and trusts buying residential property usually pay higher rates, regardless of whether they own other properties. It's important to note that the surcharge applies even if your other property is outside the UK.

Remember, while our guide provides a comprehensive overview, each property purchase is unique. It's always advisable to consult with legal and financial professionals who can offer personalised advice based on your specific circumstances. By being well-informed about stamp duty, you can better plan your finances, avoid unexpected costs, and make more confident decisions in your property journey.