Over the last 10 years, the London Home Show has attracted thousands and thousands of prospective buyers looking for advice and support in their homeownership journey. During the autumn London Home Show that took place in September 2023, over 3,800 prospective buyers attended the many talks and sessions organised by Peabody New Homes and other sponsors.

From exploring affordable housing schemes to gaining expert advice on navigating the buying process, the event serves as a one-stop destination to provide individuals with the knowledge and tools necessary to make their homeownership journey a reality and a less stressful ride. In this article, we delve into the compelling reasons why every first-time buyer and anyone who’s looking to buy a home should mark the London Home Show Spring 2024 on their calendar.

Understand how to buy a house in London and the Home Counties at the London Home Show 2024

Attending the London Home Show provides invaluable insight into stepping onto the property ladder. Whether you're a first-time buyer or looking to climb further in the housing market, the event offers guidance and resources to navigate the complexities of property ownership in London and its commuter belt.

Despite its name, the London Home Show is also useful to those looking to buy outside of the capital. Peabody New Homes can help you find your dream home in the Home Counties and outside London as well. You will also gain valuable knowledge that is applicable wherever you choose to buy. You will learn about mortgages options as well as government-backed initiatives and incentives.

The event also allows you to meet with lots of industry experts, all in one day. You can get personalised advice from property developers, mortgage advisors, conveyancing solicitors and other professionals from the housing sector.

Find out about alternative ways to buy

At the London Home Show, attendees can explore alternative ways to access homeownership, other than buying outright. With rising property prices and strict lending criteria, many prospective buyers seek innovative approaches to secure their dream home.

From Shared Ownership to London Living Rent, we will introduce you to our homes available through London and the Home Counties, catering to various options for different budgets and preferences. By exploring these alternatives, you can broaden your horizons and find the best way to purchase your first or next home.

Learn about Shared Ownership

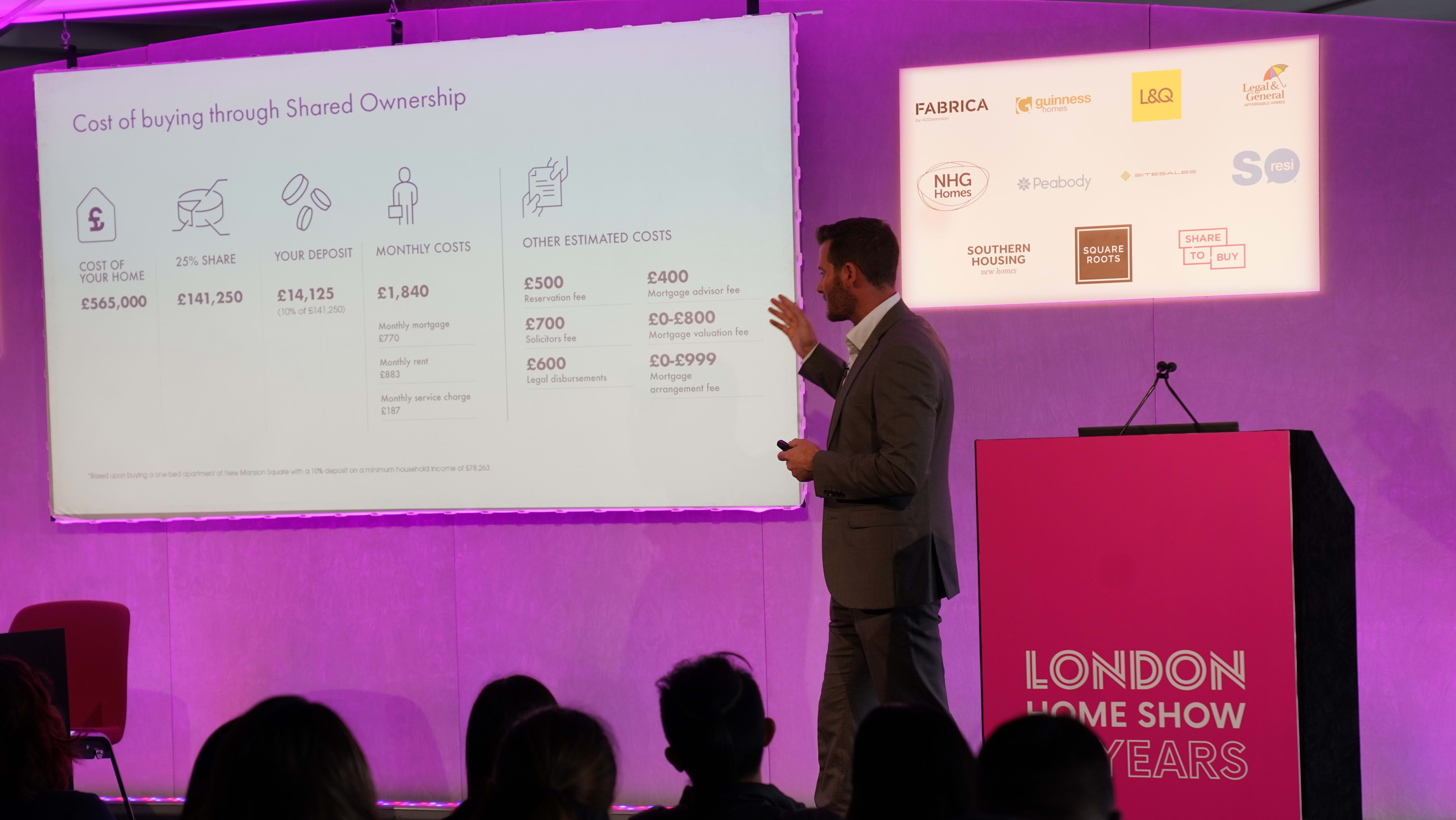

One of the key highlights of the London Home Show is the opportunity to discover Shared Ownership, a government-backed initiative aimed at making homeownership more accessible. Shared Ownership allows buyers to purchase a share of a property (typically between 25% and 75%) and pay rent on the remaining portion. Buying through Shared Ownership reduces the upfront costs of buying a home and offers greater affordability and flexibility.

With the chance to learn about eligibility criteria, application processes, and available properties, you can gain a deeper understanding of Shared Ownership and its potential to unlock homeownership opportunities in London. Peabody New Homes organised a Shared Ownership Seminar to dive into the different aspects of Shared Ownership and answer any questions you might have.

Our sales manager, Joe, will run a Shared Ownership presentation at the London Home Show on April 13

What can I learn at the Peabody New Homes’ Shared Ownership Seminar?

Unfortunately, some myths and misconceptions still come up when talking about Shared Ownership. This is why we have prepared a WForkshop dedicated to debunking those myths and giving you all the information you need to make an informed decision when it comes to buying your home through Shared Ownership.

To give you a sneak peek of what you can expect, here are the 3 most common misconceptions that people have when it comes to Shared Ownership:

1. Shared Ownership involves living with a complete stranger

False! Shared Ownership means you are a part owner of the home. It does not mean that anyone other than yourself will live in the property.

2. The rent you pay is the same as renting privately

False! Because you are purchasing a share of the property, you have to pay rent on the remaining shares. However, it is nowhere near the costs of renting now. It is cheaper to buy with Shared Ownership in many areas than it is to rent.

3. You don’t own 100% of the property

True! When buying through Shared Ownership, it is common to purchase a 25% share first. That being said, you can increase the amount of shares you own by staircasing. When you staircase to 100% of the property value, you become the sole homeowner.

These are some of the myths and misconceptions that will be debunked during our seminar. You can also attend many other talks and events such as our Ask the Expert session.

Why attend an Ask the Expert session at the London Home Show 2024?

We are taking part in an Ask the Expert session during the day. This is a great opportunity for prospective buyers to find out precise information about Shared Ownership and the buying process in general.

The panel will be composed of a chair, a Shared Ownership expert and a mortgage broker who will be talking through their areas of expertise. At the end, the session will open up to a live Q&A with the audience.

How can I attend the London Home Show 2024?

The London Home Show will take place on Saturday 13 April at the Queen Elizabeth II Centre, 5 minute walk from Westminster tube station in London. The event will run from 10am to 5pm and is free to attend. All you need to do is register to receive a ticket at no cost.